As the economic landscape in Pakistan continues to evolve, the question of where to allocate one’s funds for best growth and security remains a vital consideration for investors.

The decision-making process becomes intricate and dynamic, with myriad investment avenues available, each offering distinct benefits and risks.

The spectrum of possibilities is vast, from traditional options like real estate and government bonds to more contemporary choices such as cryptocurrency and stock trading.

However, the true challenge lies in determining the ideal mix of strategies to align with individual financial objectives and risk tolerance levels.

Navigating Investment Opportunities in Pakistan

Exploring the investment landscape in Pakistan involves understanding various vehicles suited for both beginners and seasoned investors.

From traditional options like fixed deposits and national saving certificates to more dynamic choices such as stock trading and real estate investments, individuals can tailor their portfolios to align with their risk appetite and financial goals.

Understanding the Investment Landscape

When considering investment opportunities in Pakistan, one critical aspect to weigh is the choice between passive income and active investment strategies.

Passive income avenues, such as fixed deposits and government bonds, offer stability and predictable returns, ideal for risk-averse investors.

Conversely, active investment strategies like stock trading and real estate trading require more involvement but can potentially yield higher returns for those willing to take on more risk.

Passive Income vs. Active Investment Strategies

Passive income streams and active investment strategies in Pakistan present distinct opportunities for investors to navigate the diverse landscape of investment options available in the country.

- Fixed Deposits: Offer stable returns with low risk.

- Rental Income: Provides steady income from real estate.

- Stock Trading: Involves higher risks for potential higher rewards.

- Government Bonds: Another option for passive income.

- Diversification: Spreading investments across various assets for risk management.

Investment Vehicles for Beginners and Seasoned Investors

When considering investment vehicles in Pakistan, mutual funds present an excellent entry point for both beginners and seasoned investors looking to diversify their portfolios. Mutual funds pool money from multiple investors to invest in a diversified range of assets, offering a balanced risk-return profile.

This investment avenue provides exposure to various sectors and industries, making it a popular choice for those seeking a hands-off approach to investing.

Mutual Funds: An Entry Point for a Diversified Portfolio

Mutual funds in Pakistan present a gateway to building a diversified investment portfolio, offering individuals the opportunity to access a range of investment options managed by professional fund managers.

- Diversification: Spread risk across various assets.

- Professional Management: Expert handling of investments.

- Low Entry Point: Invest with as little as Rs. 5,000.

- Tailored Options: Choose funds based on risk tolerance.

- Regulation: Oversight by the Securities and Exchange Commission of Pakistan.

Secure Investment Options with Steady Returns

When considering secure investment options with steady returns in Pakistan, traditional avenues like savings accounts offer stability and liquidity, ideal for risk-averse investors.

In contrast, prize bonds present an opportunity for potential windfall gains, although they come with a speculative element.

Balancing these two options can provide a diversified approach to ensure steady returns while allowing for higher rewards.

Savings Accounts: A Traditional Approach

Savings accounts in Pakistan offer investors a secure and traditional avenue for saving money while earning interest. These accounts are known for providing steady returns, making them suitable for individuals seeking low-risk investment options for short-term financial goals.

Commercial banks in Pakistan typically offer savings accounts with competitive interest rates, ensuring that the Deposit Protection Scheme of the State Bank of Pakistan protects funds.

Certificate of Deposit: Locking in the Interest Rates

Certificate of Deposit (CD) in Pakistan presents investors with an opportunity to safeguard their funds and lock in fixed interest rates for a specified term, typically ranging from 3 months to 5 years.

- Safeguarded investment option with guaranteed returns

- Ideal for conservative investors

- Interest rates vary based on investment amount and duration

- Offered by banks and financial institutions

- Safeguards steady returns and protects principal amount

Prize Bonds: The Chance at Windfall Gains

Prize bonds in Pakistan give investors a government-backed opportunity to win windfall gains through periodic draws.

These bonds offer a secure investment avenue with the chance for substantial returns over time.

Unlike actively managed investments, prize bonds require minimal effort from investors, making them an attractive option for those seeking both security and potential growth.

National Saving Certificates: Government-Backed Security

Among Pakistan’s diverse investment opportunities, one standout choice for secure and steady returns is the government-backed National Saving Certificates.

- Government-backed security

- Secure investment options

- Steady returns

- Low-risk investment opportunity

- Accessible through designated banks and post offices

High Yield Investment Avenues

High-yield investment avenues in Pakistan encompass real estate, known for its reliable returns over time, and the stock market, offering opportunities for significant gains through strategic share selection.

Investors can capitalize on real estate’s stability and growth potential while managing the dynamic shares market to maximize returns.

Real Estate: The Evergreen Choice

Real estate in Pakistan stands out as a high-yield investment option with the potential for significant returns. Property ownership in strategic locations can lead to substantial capital appreciation over time, making it a secure asset for passive income through rentals.

Despite economic fluctuations, the real estate sector in Pakistan has shown resilience and growth, offering long-term financial security to investors.

Islamabad’s Emerging City Centre: A Case Study

In Islamabad’s evolving urban landscape, the emergence of the city center presents promising investment opportunities in the real estate sector.

- High potential for capital appreciation

- Growing demand for properties

- Developing infrastructure enhancing property value

- Lucrative investment avenues in city center projects

- Secure and profitable choice for investors

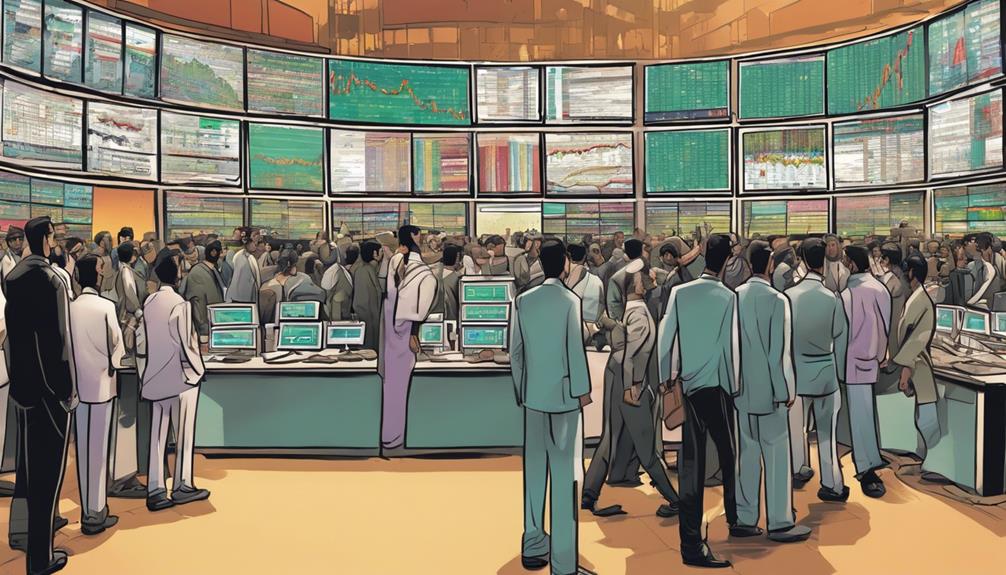

Stock Market: Navigating Best Shares to Buy

Understanding how to buy stocks in Pakistan involves researching stock market trends, analyzing company financials and performance, and diversifying one’s stock portfolio.

By keeping track of market news and events, investors can make informed decisions when selecting the best shares to buy.

Seeking guidance from financial advisors or experts can also provide valuable insights for cruising the stock market effectively.

How to Buy Stocks in Pakistan?

Accessing the Pakistani stock market to purchase stocks involves initiating a CDC account with a brokerage firm.

- Select a reputable brokerage firm

- Open a CDC account

- Research the best shares to buy

- Consider diversifying your stock portfolio

- Seek guidance from experienced stockbrokers

Alternative Investment Strategies in Pakistan

Alternative investment strategies in Pakistan present diverse opportunities for investors looking to explore beyond traditional avenues. Forex trading offers a dynamic platform for engaging in the currency market, while gold investments remain a stalwart choice for those seeking stability and wealth preservation.

Forex Trading: The Currency Play

The allure of Forex trading lies in its potential for high returns through currency speculation, offering an alternative investment avenue for individuals in Pakistan.

Unlike traditional investment options, Forex trading provides the opportunity to profit from fluctuating exchange rates and global economic events.

However, investors need to grasp the risks involved, including leverage and magnify gains and losses, before venturing into this volatile market.

Government Bonds: A Safer Bet with Attractive Returns

Government bonds in Pakistan present investors with a secure avenue boasting attractive annualized returns ranging from 16.8% to 17.85%.

- Government bonds offer stable returns

- Safer investment option

- Diversifies portfolio

- Low-risk option

- Historically consistent performance

Gold Investments: The Traditional Wealth Store

Gold investments in Pakistan serve as a cornerstone in many investment portfolios due to their historical stability and value retention.

With gold priced at around Rs. 143,600 per tola, investors often turn to this precious metal as a safe haven against economic uncertainties and inflation.

The enduring allure of gold as a traditional wealth store continues to attract individuals seeking to diversify their investment strategies and safeguard their wealth over time.

3D Printing: Investing in the Future of Manufacturing

Investing in 3D printing presents a forward-looking opportunity for individuals looking to engage in the future of manufacturing in Pakistan.

This innovative technology offers a cost-effective way to produce prototypes, customized products, and replacement parts.

With an investment starting at Rs. 150,000, investors can capitalize on the growing demand for 3D printing services and products in various industries like healthcare, automotive, and fashion.

Innovative and Niche Investment Opportunities

In the domain of innovative and niche investment opportunities in Pakistan, avenues like peer-to-peer lending offer a modern approach to investing, tapping into the digital age’s potential.

Additionally, franchising presents a strategic option for investors looking to capitalize on established brand success and expand their portfolio in a structured manner.

Exploring these unique investment paths requires a thorough understanding of the market dynamics and a strategic mindset to navigate the complexities of these specialized sectors.

Peer-to-Peer Lending: A Digital Age Investment

Peer-to-peer lending in Pakistan presents an innovative investment avenue where individuals lend money to borrowers through online platforms, offering potential returns starting at Rs. 10,000. This digital-age investment opportunity allows investors to diversify their portfolio by engaging in various loan opportunities, with returns influenced by borrower creditworthiness and platform terms.

With lower entry barriers, peer-to-peer lending provides a niche investment option worth exploring for those seeking alternative ways to grow their funds.

Renewable Energy Projects: Contributing to a Greener Tomorrow

Renewable energy projects in Pakistan present a forward-thinking approach towards fostering a sustainable and environmentally friendly energy landscape for the future.

- Harness sustainable energy sources like solar, wind, and hydroelectric power.

- Offer financial returns while reducing carbon emissions.

- Promote environmental sustainability.

- Provide innovative investment opportunities.

- Contribute to a greener tomorrow.

Franchising: Building on Established Brand Success

Franchising in Pakistan offers investors the chance to tap into established brand success, providing a pathway to innovative and niche investment opportunities within various industries.

With a higher success rate compared to starting a new business independently, franchising allows individuals to benefit from proven business models and ongoing support from the franchisor.

Choosing a franchise that aligns with one’s interests and financial objectives can offer a strategic approach to active investing in the market.

Why Franchising Presents an Active Investment Opportunity

Investors looking to capitalize on innovative and niche investment opportunities should consider exploring franchising as a means to leverage established brand success and proven business models.

- Franchising offers a chance to invest in a proven business model with a recognized brand

- Opportunity to enter niche markets or industries with established success

- Built-in support systems and training for franchisees

- Faster route to profitability compared to starting a business from scratch

- Benefit from brand recognition and marketing efforts of the parent company

Maximizing Returns with Limited Resources

To maximize returns with limited resources, individuals with small budgets can implement smart strategies tailored to their financial constraints.

Understanding the best investment options for youngsters in Pakistan is essential for optimizing returns within limited resources.

Smart Strategies for Small Budgets

When investing with limited resources, it is important to focus on strategies that can maximize returns effectively.

Starting early and investing regularly, understanding different investment options, seeking advice from financial experts, monitoring investments, and maintaining a long-term perspective are key elements to take into account.

Where to Invest 1000 Rupees in Pakistan?

Considering the limited budget of 1000 Rupees in Pakistan, one may explore various avenues to maximize returns and generate incremental income.

- Start a small business like tutoring or freelancing.

- Invest in low-cost ETFs or mutual funds.

- Explore peer-to-peer lending platforms.

- Invest in a small property.

- Utilize online platforms for skill-based opportunities.

The Best Investment for Youngsters in Pakistan

Youngsters in Pakistan can strategically invest in areas that align with their personal skills to secure long-term gains. By identifying their strengths and interests, young investors can capitalize on opportunities that offer the potential for significant returns.

Leveraging personal skills maximizes returns with limited resources and fosters a sense of fulfillment and success in the investment journey.

Leveraging Personal Skills for Long-term Gains

Maximizing returns with limited resources can be achieved by leveraging personal skills for long-term gains. This offers young investors in Pakistan the opportunity to invest strategically in their future financial growth.

- Starting a side business

- Monetizing personal skills

- Utilizing online platforms

- Aligning business with interests

- Effective time management

Making Informed Investment Decisions

When considering where to place your investments in Pakistan, the choice between real estate and stocks is important. Real estate offers tangible assets that can provide steady rental income and potential capital appreciation. At the same time, stocks offer ownership in businesses with the potential for higher returns but also higher volatility.

Understanding the key differences between these two investment options is essential in making informed decisions that align with your financial goals and risk tolerance.

Real Estate vs. Stocks: Where to Place Your Bets

Investors must carefully consider their risk tolerance, investment goals, and market conditions when deciding between real estate and stocks in Pakistan.

Real estate investments offer stability and potential profits over time, while stocks can reflect the country’s economic health and provide significant returns.

Building a diversified investment portfolio that includes both real estate and stocks can help mitigate risks and maximize potential gains in the Pakistani market.

The Importance of a Diversified Investment Portfolio

Diversifying your investment portfolio is a strategic approach to mitigate risk and enhance potential returns by spreading investments across various asset classes.

- Reduces overall risk

- Helps optimize returns

- Matches risk tolerance

- Aligns with investment goals

- Balances real estate and stocks

Common Queries Addressed

When it comes to investing small amounts of money in Pakistan, individuals often wonder about the best options that can yield significant returns.

Understanding where to allocate limited funds can be essential for those looking to grow their wealth gradually.

Where to Invest Small Amounts of Money in Pakistan

When considering where to invest small amounts of money in Pakistan, individuals often inquire about options that align with their retirement goals.

It is essential to explore investment avenues that can provide long-term growth and financial stability, especially when starting with limited funds.

Investing with a View Toward Retirement

To secure a stable retirement in Pakistan, individuals can initiate a savings plan with as little as Rs. 1,000 per month, aiming to build a financial cushion for the future.

- Retirement Fund: Start early and contribute regularly.

- Pension Fund: Consider long-term benefits and security.

- Public Provident Fund: Tax benefits and long-term savings.

- National Pension System: Secure your retirement through contributions.

- Fixed Deposit Accounts: Safe option for retirement savings.

The Final Verdict on Investment in Pakistan

When considering investment options in Pakistan, it is important to strike a balance between risk and reward for best growth.

This involves carefully evaluating the potential returns of various investment avenues against the associated risks.

Balancing Risk and Reward for Optimal Growth

Balancing risk and reward is fundamental to achieving the best growth in investments. This emphasizes the importance of understanding the correlation between these factors.

Evaluating personal risk tolerance is essential in making well-informed investment decisions. It guides individuals in selecting suitable avenues for their financial goals.

Diversification across various asset classes and vigilant monitoring of investments are key strategies to mitigate risks and maximize potential returns.

The Path to Financial Independence through Wise Investments

In steering the journey towards financial independence through wise investments in Pakistan, strategic decision-making plays a pivotal role in achieving peak growth.

- Real Estate Market: Explore the potential for growth and rental income.

- Stock Exchange: Consider investing in stocks for long-term returns.

- Investment Options in Pakistan: Evaluate various avenues based on risk tolerance.

- Financial Goals: Set clear objectives for wealth accumulation.

- Risk Management: Mitigate risks through diversification and informed choices.

Unveiling the Future of Investing in Pakistan

The future of investing in Pakistan holds promise as the landscape continues to evolve with diverse opportunities. Factors such as technological advancements, government policies, and market trends will play a vital role in shaping investment decisions.

Exploring emerging trends and projections can guide investors toward informed choices in the dynamic Pakistani market.

Emerging Trends and Future Projections

Analyzing the role of technology in shaping investment opportunities is important for understanding the future landscape of investing in Pakistan.

Technological advancements, such as digital platforms for trading and investment analysis tools, are revolutionizing how individuals approach investing.

The Role of Technology in Shaping Investment Opportunities

Technology is reshaping the landscape of investment opportunities in Pakistan by paving the way for a future of innovative and accessible investing strategies. Online trading platforms offer seamless buying and selling, while robo-advisors provide automated investment advice. Additionally, mobile apps empower investors with real-time updates, and blockchain technology guarantees secure investment transactions. The evolution of the investment landscape in Pakistan is underway.

- Online trading platforms offer seamless buying and selling.

- Robo-advisors provide automated investment advice.

- Mobile apps empower investors with real-time updates.

- Blockchain technology guarantees secure investment transactions.

- Evolution of the investment landscape in Pakistan is underway.

Leaving a Legacy Through Smart Investments

Investing smartly can be a powerful way to establish a financial legacy for future generations. Individuals can lay the foundation for long-term wealth accumulation and stability by making strategic investment choices.

Selecting the right investment opportunities in Pakistan is essential for ensuring a lasting impact and securing a prosperous future for loved ones.

The Ultimate Goal: Creating Passive Income Streams

Establishing passive income streams is a strategic way to secure financial stability for the future and leave a lasting legacy through smart investments.

Teaching the next generation about the importance of investing in assets that generate passive income can set them up for financial success and independence.

Teaching the Next Generation About Investing

In preparing the next generation for financial success and fostering a legacy through intelligent investments, the emphasis lies in instilling early education in investing practices.

- Empowers children: Equips them with financial literacy.

- Builds generational wealth: Assures a secure future.

- Promotes responsible money management: Encourages smart decision-making.

- Creates passive income streams: Establishes long-term financial stability.

- Transfers knowledge: Leads to prosperity for future generations.

The Road Ahead: Wrapping Up Insights on Investment in Pakistan

The evolving landscape of investment opportunities in Pakistan presents a promising outlook for individuals seeking to diversify their portfolios and capitalize on various financial instruments. In Pakistan, prominent investment options include stocks, real estate, gold, mutual funds, and prize bonds.

Real estate investments offer stable returns and potential profits, such as in projects like Giga Mall Extension. The stock market reflects economic health and has recently demonstrated significant returns. Gold investments act as a safe hedge against inflation, maintaining value over time. Additionally, prize bonds, endorsed by the government, provide hassle-free investment opportunities with draws held every three months.

Exploring these avenues can offer individuals a mix of both stability and growth potential in the Pakistani investment landscape.

FIND US ON SOCIALS