In the investment banking domain in India, the question of how much professionals in this field earn is a multifaceted inquiry. The compensation structures vary greatly, influenced by factors such as experience, expertise, and the complex dynamics of the projects undertaken.

From the initial stages of a career, where the income starts at a modest level, to the pinnacle of success, where substantial salaries are commonplace, the monetary landscape of investment bankers in India is intriguing. Understanding the nuances of this financial domain reveals the potential earnings and the strategic maneuvers that can lead to lucrative outcomes.

Unveiling the Investment Banking Realm in India

In India’s investment banking domain, understanding who qualifies as an investment banker is vital. These professionals undertake a multifaceted role, encompassing financial analysis, client relationships, and strategic advisory services.

The intricacies of an investment banker’s responsibilities shape the sector’s dynamics and highlight the diverse skill set required for success in this field.

Who Exactly is an Investment Banker?

Investment bankers in India play a pivotal role in evaluating financial health, offering strategic advice on capital raising, coordinating mergers, and ensuring adherence to regulatory standards within the dynamic world of investment banking.

- Responsible for evaluating financial health, offering advice on raising capital, coordinating mergers, and ensuring regulatory compliance.

- Fix stock prices, advise on issuing stocks or bonds, and strategize financial transactions.

- Earn between ₹12 lakhs to ₹85 lakhs annually, with freshers starting at ₹4 lakhs to ₹7 lakhs per year.

- Salary is influenced by skills, qualifications, experience level, and the organization they work for.

The Multifaceted Role of an Investment Banker

Investment bankers in India are instrumental in evaluating companies’ financial health and devising strategic financial strategies to drive growth. Their expertise is vital in providing valuable financial and investment advice to facilitate capital raising for businesses through diverse channels.

Investment bankers in India also play a pivotal role in managing mergers and acquisitions, ensuring compliance with regulations, and advising on equity and debt offerings to fulfill companies’ financial objectives.

Core Responsibilities and Expertise

Amidst India’s dynamic financial landscape, an investment banker’s multifaceted role unfolds as a pivotal driver in orchestrating strategic financial decisions and transactions.

- Evaluating financial health

- Providing advice on capital raising

- Coordinating mergers or acquisitions

- Ensuring regulatory compliance

The Strategic Impact on Businesses

Playing a pivotal role in shaping strategic financial decisions and transactions within the dynamic financial landscape of India, an investment banker’s multifaceted responsibilities encompass evaluating financial health, advising on capital raising, coordinating mergers or acquisitions, and ensuring regulatory compliance.

| Impact on Businesses | Responsibilities | Expertise |

|---|---|---|

| Strategic Financial Decisions | Advising on capital raising and mergers or acquisitions | Financial Analysis |

| Regulatory Compliance | Ensuring compliance with financial regulations | Risk Management |

| Sustainable Growth Strategies | Evaluating financial health and devising strategic growth plans | Market Trends Analysis |

The Investment Banking Skillset: A Prerequisite for Success

In India’s competitive landscape of investment banking, possessing essential skills is paramount for career advancement and salary growth.

A complete skill set encompassing financial analysis, modeling, risk assessment, and proficiency in tools like Microsoft Excel is essential for aspiring investment bankers.

The direct correlation between honed skills and salary prospects underscores the significance of continuous skill development in this dynamic industry.

Essential Skills for Aspiring Investment Bankers

A successful investment banker must possess a combination of analytical prowess and effective communication skills to interpret financial data and engage with clients and stakeholders.

Additionally, leadership abilities are vital for maneuvering complex financial transactions, while strong interpersonal skills facilitate collaboration within the team.

These key competencies form the foundation of the investment banking skillset and are essential for aspiring professionals looking to excel in the industry.

Analytical and Communication Prowess

Investment bankers must possess a combination of strong analytical and communication skills to effectively navigate the complexities of financial markets and convey critical information to stakeholders.

- Strong analytical skills are essential for evaluating financial data and market trends.

- Effective communication skills are vital for conveying complex financial information.

- Data-driven decision-making is key to success in investment banking.

- Proficiency in financial modeling aids in creating accurate projections and valuations.

Leadership and Interpersonal Abilities

Strong leadership and interpersonal abilities are imperative for success in the demanding field of investment banking. Effective team management, client relationship building, and negotiation skills are essential for steering through the complex financial landscape.

Communication prowess, problem-solving capabilities, and adaptability further enhance an investment banker’s skill set, enabling them to excel in delivering innovative solutions and thriving in dynamic environments.

How Skills Directly Influence Salary Prospects

Proficiency in key investment banking skills directly correlates with the salary prospects of professionals in the industry.

- Financial Analysis and Modeling: Mastery of these skills can impact an investment banker’s earning potential.

- Proficiency in Tools: Knowledge of Microsoft Excel and financial software can lead to higher pay.

- Analytical Skills: Strong capabilities in financial data analysis are vital for salary growth.

- Communication Skills: Effective client interaction through strong communication can contribute to increased earnings in the field.

The Financial Rewards: Understanding Investment Banker Salaries in India

Investment banker salaries in India exhibit a diverse range, with entry-level professionals typically starting at around INR 6-10 lakhs per annum.

Comparing these figures with those of other countries can provide insight into the global competitiveness of the Indian investment banking sector.

Understanding the average salary structure for investment bankers in India and how it measures internationally is essential for professionals seeking to enter or progress in this field.

The Average Salary Structure for Investment Bankers

The salary structure for investment bankers in India follows a trajectory from entry-level to senior positions, each offering distinct remuneration packages.

Freshers typically start with annual salaries ranging from ₹4 lakhs to ₹7 lakhs, gradually progressing to mid-level roles earning between ₹15-25 lakhs and potentially reaching senior positions with salaries exceeding ₹30 lakhs.

This hierarchical progression reflects the increasing responsibilities, expertise, and value investment bankers bring to their roles, culminating in competitive financial rewards in the Indian market.

The Starting Point: Fresher and Early Career Salaries

Early in their careers, budding professionals in the investment banking industry in India can anticipate earning between ₹4 lakhs to ₹7 lakhs annually. Freshers typically earn between ₹4 lakhs to ₹7 lakhs per year. Early career investment bankers can make around ₹6-10 lakhs annually.

Entry-level salaries range from ₹2.0 lakhs to ₹10 lakhs. The starting point for investment bankers in India involves a salary range of ₹2.0 lakhs to ₹10 lakhs.

Climbing the Ladder: Mid-Level and Senior-Level Remunerations

Climbing the career hierarchy within the investment banking sector in India correlates directly with substantial increases in remuneration. This reflects the industry’s recognition of expertise, responsibilities, and market demand.

Mid-level investment bankers typically earn between INR 15-25 lakhs annually, while senior-level professionals can command salaries exceeding INR 50 lakhs per year based on experience and performance. This salary progression underscores the financial rewards and industry growth opportunities.

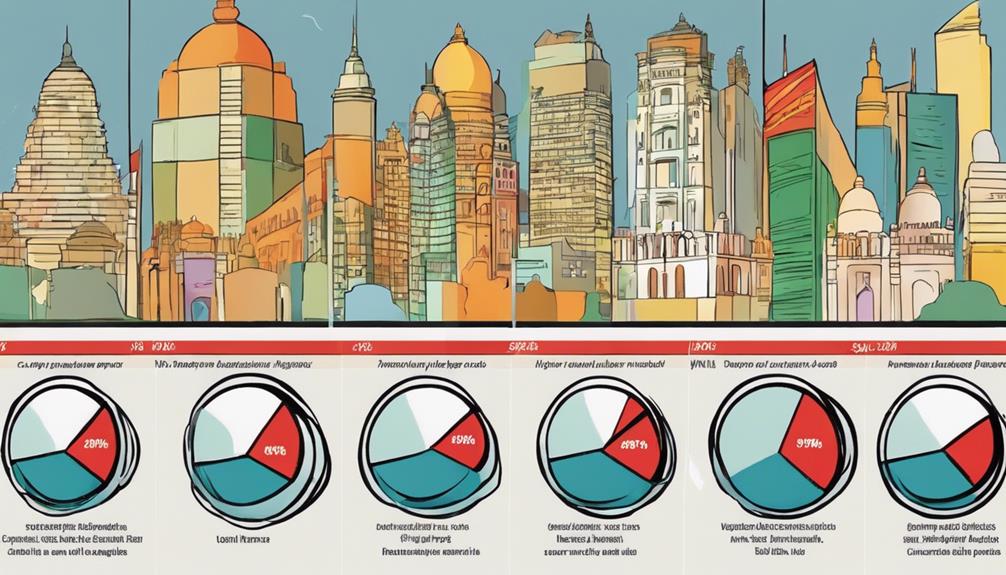

Comparing Investment Banker Salary in India with Other Countries

When comparing investment banker salaries in India with other countries like the United States and the United Kingdom, it is essential to take a global perspective.

Salaries for investment bankers vary greatly across different regions, with factors such as cost of living and market demand playing a vital role in determining compensation packages.

Understanding these differences can provide valuable insights into the financial rewards of pursuing a career in investment banking in India versus other nations.

Investment Banker Salary in the United States and the United Kingdom

Comparing Investment Banker salaries in India with those in the United States and the United Kingdom reveals significant variations in annual compensation levels based on experience, firm, and location.

- United States: Average salary $100,000 to $150,000.

- United Kingdom: Average salary £50,000 to £200,000.

- Bonuses: Significant bonuses are available in the US and UK.

- Influencing Factors: Location, firm reputation, experience, and market conditions.

A Global Perspective: Canada, UAE, and Beyond

Investment banking professionals in India are positioned to gain valuable insights into the global landscape by examining salary comparisons with countries like Canada and the UAE. In Canada, investment bankers earn an average of CAD 80,000 to CAD 150,000 annually, while in the UAE, salaries range from AED 120,000 to AED 400,000 per year. Despite regional variations, Indian investment bankers can achieve significant financial rewards compared to their global counterparts.

| Country | Average Salary Range |

|---|---|

| Canada | CAD 80,000 – CAD 150,000 |

| UAE | AED 120,000 – AED 400,000 |

Navigating Through the Factors Affecting Investment Banker Salaries in India

Factors such as experience and expertise play a critical role in determining compensation levels when considering investment banker salaries in India.

Additionally, the location of the job and the company’s reputation are significant influencers of salary differentials in the industry.

Understanding these key factors is essential for professionals seeking to navigate the complexities of investment banking compensation structures in India.

The Role of Experience and Expertise

How do the levels of experience and expertise impact the salary structure of investment bankers in India?

Experience and expertise are pivotal in determining the earning potential of investment bankers in India. Here’s how these factors influence salary variations:

- Experience Levels: Entry-level bankers typically earn between INR 6-10 lakhs annually, mid-level professionals can expect around INR 15-25 lakhs, and senior-level bankers often earn over INR 50 lakhs per year.

- Expertise: Specialized skills and knowledge in areas like mergers and acquisitions or capital markets can lead to higher compensation packages.

- Project Complexity: Handling intricate projects can result in additional bonuses and higher pay scales.

- Negotiation Skills: Effective negotiation abilities can play a significant role in securing better salary packages and bonuses in the field of investment banking.

The Significance of Location and Company

The location and company an investment banker chooses to work for in India can significantly impact their salary. Metropolitan areas like Mumbai tend to offer higher salaries due to the concentration of financial institutions. At the same time, prestigious firms such as JP Morgan Chase and Goldman Sachs are known for providing top compensation packages.

Understanding the interplay between location and company reputation is important for investment bankers aiming to maximize their earning potential in India.

Metropolitan vs. Non-Metropolitan Areas

Investment banker salaries in India exhibit significant disparities between metropolitan and non-metropolitan areas, influenced by factors such as cost of living, demand, and corporate presence.

- Higher cost of living in metropolitan areas

- Increased demand for investment bankers in major cities

- Presence of major financial institutions and corporations in metropolitan areas

- Lower demand, fewer financial opportunities, and reduced competition in non-metropolitan areas

Prestigious Firms: JP Morgan Chase, Goldman Sachs, and More

Salaries for investment bankers in India, particularly at prestigious firms like JP Morgan Chase and Goldman Sachs, are greatly influenced by factors such as company reputation, size, and geographic location. Working for these renowned firms can lead to substantially higher salaries and better bonuses due to their global standing.

Location, with major cities like Mumbai offering higher pay, also plays a vital role in determining an investment banker’s earnings.

A Closer Look at Company-Wise Investment Banker Salary

When analyzing company-wise investment banker salaries in India, it is important to benchmark top financial institutions to understand the salary landscape comprehensively.

By examining how companies like Accenture, HDFC Bank, Wells Fargo, BNP Paribas, and M L Bhuwania & Co compensate their investment bankers, one can gain insights into the industry’s range and disparities in salary offerings.

This comparison sheds light on the varying salary structures, from higher-end packages at multinational corporations to more modest compensations at smaller firms, providing valuable context for professionals considering their career paths.

Benchmarking Top Financial Institutions

When benchmarking top financial institutions like JP Morgan Chase and Goldman Sachs, a comparative analysis reveals the spectrum of salaries across various companies such as ICICI Bank, Axis Bank, and HDFC Bank.

Understanding the salary ranges offered by these institutions provides valuable insights into the compensation structures within the investment banking sector.

Analyzing the nuances of salary packages at different financial institutions can shed light on the competitive landscape for investment bankers in India.

JP Morgan Chase and Goldman Sachs: A Comparative Analysis

In the domain of financial institutions in India, a comparative analysis between JP Morgan Chase and Goldman Sachs reveals fascinating insights into the salary structures for investment bankers in these prestigious firms.

JP Morgan Chase:

- Average annual salary: ₹34 Lakhs

- Salary range: ₹29 Lakhs to ₹35 Lakhs

- Starting salary: ₹20 Lakhs

Goldman Sachs:

- Top earners: Up to ₹60 Lakhs

The Spectrum of Salaries Across ICICI Bank, Axis Bank, and HDFC Bank

Examining the salary structures for investment bankers at ICICI Bank, Axis Bank, and HDFC Bank reveals significant variations in compensation packages within the top financial institutions in India.

ICICI Bank offers an average monthly salary of ₹59,667, with an annual range from ₹20,00,000 to ₹2,00,00,000.

Axis Bank’s investment bankers earn between ₹78,00,000 to ₹92,00,000 annually.

HDFC Bank offers a salary range of ₹20,00,000 to ₹24,00,000 per year.

The Pathway to Becoming an Investment Banker in India

Becoming an Investment Banker in India requires a strong educational foundation in finance or a related field, typically starting with a bachelor’s degree.

Advanced degrees like an MBA or a CFA can further enhance career prospects in the field.

Developing analytical, communication, teamwork, and leadership skills are essential steps in the journey toward a successful career as an Investment Banker in India.

Qualifications and Credentials Required

A foundational qualification required to pursue a career as an investment banker in India is a bachelor’s degree in finance or a related field. Advanced degrees like an MBA or a CFA (Chartered Financial Analyst) can provide a key edge for aspiring professionals.

Analytical skills are critical for effectively analyzing financial data, while strong communication skills are essential for client interactions and deal negotiations. Additionally, teamwork and leadership abilities are important for collaborating with colleagues and leading projects efficiently.

These qualifications and credentials are key components for individuals aiming to excel in India’s dynamic field of investment banking.

The Journey from Education to Employment

The progression toward a career in investment banking in India involves a structured pathway that encompasses educational attainment, skill development, and hierarchical advancement within financial institutions. Aspiring investment bankers typically start with a Bachelor’s degree in finance or a related field, followed by pursuing advanced degrees such as an MBA or CFA for enhanced qualifications. Developing strong analytical and communication skills and fostering teamwork and leadership qualities are vital for success in this field. The journey from education to employment as an investment banker in India entails gaining experience, acquiring specialized skills, and advancing through different hierarchical levels within financial institutions.

| Key Steps | Description |

|---|---|

| Educational Attainment | Pursue a Bachelor’s degree in finance or a related field |

| Skill Development | Obtain advanced degrees like MBA or CFA, develop analytical and communication skills |

| Hierarchical Advancement | Progress through different levels within financial institutions, gain experience |

The Future Landscape: What Awaits Investment Bankers in India?

The future landscape for investment bankers in India looks promising, with increasing demand for skilled professionals in the field anticipated in 2024 and beyond.

As the financial sector evolves, investment bankers will need to adapt to new technologies, regulations, and market trends to stay competitive and seize emerging opportunities.

Specializing in areas like M&A and honing networking and relationship-building skills will be essential for investment bankers to thrive in the dynamic Indian market.

Prospects in 2024 and Beyond

Given the escalating demand for skilled professionals in the investment banking sector in India, the future landscape presents promising opportunities for career growth and lucrative pay scales for professionals in the field.

- The positive outlook for 2024 and beyond indicates increasing demand for investment bankers in India.

- Ample career advancement opportunities and higher pay scales are expected in the future landscape.

- Specialized areas like M&A could offer significant earning potential growth.

- Networking and relationship building will continue to be essential for success in the industry.

Investment bankers need to stay updated with market trends, industry insights and continuously develop their skills to maximize opportunities in the evolving landscape.

Adapting to the Evolving Financial Sector

Adapting to India’s evolving financial landscape requires investment bankers to cultivate agility and foresight in response to dynamic market shifts. With the financial sector continually transforming due to technological advancements, regulatory changes, and global economic trends, investment bankers must stay updated on industry developments to remain competitive.

Factors such as the rise of digital banking, the increasing demand for sustainable investments, and the growing importance of data analytics are reshaping the future landscape for investment bankers in India. The ability to adapt to these changes will be vital for professionals looking to thrive in this evolving environment.

Embracing innovation, honing specialized skills, and building robust networks will be key strategies for success in the dynamic and competitive financial sector of tomorrow.

Investment Banker Salary: A Comparative Analysis Across Locations

When comparing investment banker salaries across locations, factors like urban versus rural settings play a pivotal role in determining compensation packages.

Additionally, international comparisons between India and other major financial hubs worldwide shed light on the competitiveness of salaries in the Indian market.

Understanding these variations can provide valuable insights into the overall financial landscape for investment bankers in different regions.

Urban vs. Rural: Salary Variations

Urbanization profoundly impacts the salary differentials among investment bankers in India, with stark variations observed between urban and rural locations.

Urban Areas:

- Higher living costs drive up salaries in cities like Mumbai and Delhi.

- Tier-2 cities like Pune or Ahmedabad may offer lower salaries due to differing cost of living.

International Banks:

- Multinational banks operating in urban hubs may provide higher compensation packages.

Regional Disparities:

- Salary structures in Bangalore and Hyderabad fluctuate based on economic conditions and financial market presence.

These disparities reflect the influence of location, market demand, and cost of living on the remuneration of investment bankers across different regions in India.

International Comparisons: India vs. The World

In comparing investment banker salaries across different locations globally, it is evident that Indian investment bankers generally earn lower incomes than their counterparts in developed countries such as the United States and the United Kingdom. Factors such as cost of living, market demand, and economic conditions contribute to these salary variations. International investment bankers often have higher earning potential due to differences in financial markets and opportunities. Despite the salary gap, investment banking in India remains a lucrative career choice with growth prospects.

| Location | Average Salary (in INR) |

|---|---|

| India | Lower than developed countries |

| United States | Higher than India |

| United Kingdom | Higher than India |

| Singapore | Varies, often higher than India |

| Hong Kong | Varies, often higher than India |

Frequently Asked Questions (FAQs)

When considering investment banking salaries in India, understanding the entry-level salary is important for aspiring professionals looking to enter the field.

Exploring which companies offer the best salaries can provide valuable insights into potential career paths and opportunities for growth.

Additionally, analyzing how experience impacts salary levels in investment banking can help individuals plan their career trajectories effectively.

What is the Entry-Level Salary for an Investment Banker in India?

With an average entry-level salary of approximately INR 8 lakhs per annum, aspiring investment bankers in India can anticipate earning between INR 6-10 lakhs annually as they start on their careers in the dynamic financial sector.

- Entry-level salary typically ranges from INR 6-10 lakhs per annum.

- Freshers can expect around INR 6-10 lakhs annually.

- Starting salary may be around INR 6 lakhs per year.

- The average entry-level salary is approximately INR 8 lakhs per annum.

Which Companies Offer the Best Salaries for Investment Bankers?

Companies renowned for their compensation packages in the financial sector include Goldman Sachs and JP Morgan Chase, standing out as top contenders for offering competitive salaries to investment bankers in India. Accenture, HDFC Bank, Wells Fargo, and BNP Paribas also provide attractive salary ranges for investment bankers in the country. Below is a comparison of the annual salary ranges offered by these companies:

| Company | Salary Range (INR) |

|---|---|

| Goldman Sachs | ₹78,00,000 – ₹92,00,000 |

| JP Morgan Chase | ₹20,00,000 – ₹24,00,000 |

| Accenture | ₹14,00,000 – ₹16,00,000 |

| HDFC Bank | ₹3,00,000 – ₹4,00,000 |

| BNP Paribas |

How Does Experience Affect Salary in Investment Banking?

How does the level of experience impact the salary of investment bankers in India?

Experience in investment banking greatly influences salary levels. Here’s how it affects earnings:

- Entry-level investment bankers typically earn between ₹6-10 lakhs per annum.

- Mid-level investment bankers can expect salaries ranging from ₹15-25 lakhs per annum.

- Senior-level investment bankers earn over ₹50 lakhs per annum on average.

- The average annual salary in investment banking is influenced by experience levels, ranging from ₹2.0 Lakhs to ₹60.0 Lakhs.

These salary ranges demonstrate the direct correlation between experience and earning potential within the investment banking sector in India.

A Glimpse into the Future: Investment Banking in India 2024

In 2024, Investment Banking in India is poised for significant growth, with emerging trends and predictions shaping the sector.

The impact of global economic shifts on Indian Investment Banking is a critical aspect to take into account, influencing the industry’s trajectory in the coming years.

As the demand for skilled professionals rises and specialized areas like Mergers and Acquisitions gain prominence, Investment Bankers can anticipate increased earning potential and expanded career opportunities by 2024.

Emerging Trends and Predictions

With the anticipated growth and evolution of the investment banking landscape in India by 2024, the average salary for professionals in this sector is poised to experience a significant uptick. This surge can be attributed to the increasing demand and competition within the market, leading to higher compensation packages.

Specialized skills such as financial modeling and data analytics will be highly sought after, resulting in elevated salary offers for investment bankers. Moreover, investment banking firms are expected to enhance their bonus and incentive structures to attract and retain top talent in the industry.

Additionally, the shift towards more technology-driven roles and the focus on sustainable finance and ESG investments will likely open up new avenues for investment bankers, impacting their earning potential.

The Impact of Global Economic Shifts on Indian Investment Banking

The impending shifts in the global economic landscape are poised to profoundly influence the trajectory of Indian investment banking as it progresses toward 2024. These changes can majorly impact market dynamics, investor behavior, technological advancements, and regulatory frameworks within the sector. Indian investment banking is likely to witness a move towards increased digitization, sustainable investing practices, and closer collaboration with international markets. Adapting to evolving global economic trends and geopolitical factors will be essential for the growth and sustainability of the industry in India.

| Factors Influencing Indian Investment Banking in 2024 |

|---|

| Market Dynamics and Investor Behavior |

| Technological Advancements and Digitization |

| Sustainable and ESG Investing Practices |

| Collaboration with International Markets |

| Regulatory Changes and Geopolitical Factors |

Crafting Your Career in Investment Banking

Crafting a successful career in investment banking requires strategic steps and a commitment to lifelong learning to stay abreast of industry trends and advancements. Aspiring professionals should focus on building a strong foundation in finance, honing their analytical skills, and cultivating a network of industry contacts.

Career advancement in investment banking is often driven by a combination of technical expertise, soft skills, and the ability to navigate complex financial transactions with precision and efficiency.

Strategic Steps for Aspiring Investment Bankers

To excel in the competitive field of investment banking, aspiring professionals must strategically plan their career paths by diligently acquiring relevant qualifications and honing essential skills.

- Pursue a Bachelor’s degree in finance or a related field to build a strong foundation.

- Consider advanced degrees like an MBA or CFA to enhance your qualifications.

- Develop strong analytical skills for financial data analysis.

- Hone communication skills for client interaction and relationship building.

These strategic steps will help aspiring investment bankers stand out in the competitive landscape and equip them with the necessary tools to succeed in this dynamic and rewarding industry.

Lifelong Learning and Career Advancement

In the dynamic landscape of investment banking, continuous learning and strategic career advancement are key components for professionals aiming to excel in the field. Lifelong learning is vital for staying abreast of market trends, regulations, and financial strategies. Investment bankers can enhance their skills through courses, certifications, and workshops, opening doors for career progression.

Networking is instrumental in gaining access to new opportunities, mentorship, and industry insights. Taking on challenging projects and leadership roles can lead to promotions and salary increments. Proactive career planning, goal setting, and feedback seeking are essential strategies for maneuvering a successful career path in the competitive domain of investment banking.

Concluding Insights: Maximizing Your Investment Banking Salary in India

To maximize your investment banking salary in India, it is important to navigate challenges and seize opportunities by continuously developing your skills and expanding your professional network.

You can effectively leverage salary opportunities within the investment banking sector by staying updated on market trends and industry insights.

Moreover, honing your negotiation skills and seeking performance-based bonuses can greatly impact your earning potential as an investment banker in India.

Navigating Challenges and Seizing Opportunities

Successfully handling challenges and seizing opportunities in the investment banking sector in India can greatly impact one’s ability to maximize their salary potential.

To excel in this competitive field, individuals must enhance their skills in areas like financial modeling, actively pursue professional development opportunities, build a robust professional network, and stay abreast of market trends and industry insights.

The Importance of Continuous Skill Development and Networking

Enhancing and continuously updating skills and fostering a robust professional network are pivotal strategies for investment bankers in India to optimize their salary potential and career growth. Professional development opportunities and effective negotiation skills are essential for maximizing earning potential in the field. Building a strong network can provide access to higher-paying opportunities, further boosting income. Additionally, staying updated on market trends and industry insights is crucial for enhancing salary growth in India. The table below illustrates the key elements that contribute to maximizing an investment banker’s salary in the Indian market:

| Key Strategies for Maximizing Salary in Investment Banking | |

|---|---|

| Continuous Skill Enhancement | Professional Development Opportunities |

| Building a Strong Professional Network | Effective Negotiation Skills |

| Staying Updated on Market Trends and Industry Insights |

Make informed investment decisions by learning about the best places to invest money in Pakistan.

FIND US ON SOCIALS